Is Retirement Income Taxable In New York State . as a nyslrs retiree, your pension will not be subject to new york state or local income tax. New york doesn’t tax social security benefits, either. your pension income is not taxable in new york state when it is paid by: most nyslrs pensions are subject to federal income tax. taxes on retirement income: If a nonresident of new york state receives a pension from a nys source, is that taxable by new york state? nyslrs pensions are not subject to new york state or local income tax, but if you move to another state, that state may tax. New york gives every resident who is age 59.5 or older a break on taxes against retirement income from. New york state or local government. Section 114 of title 4 of the u.s. All social security retirement benefits are exempt from taxation. If your last federal tax bill or return was larger than you expected and you want to.

from www.elikarealestate.com

New york doesn’t tax social security benefits, either. New york gives every resident who is age 59.5 or older a break on taxes against retirement income from. New york state or local government. as a nyslrs retiree, your pension will not be subject to new york state or local income tax. most nyslrs pensions are subject to federal income tax. taxes on retirement income: nyslrs pensions are not subject to new york state or local income tax, but if you move to another state, that state may tax. All social security retirement benefits are exempt from taxation. Section 114 of title 4 of the u.s. your pension income is not taxable in new york state when it is paid by:

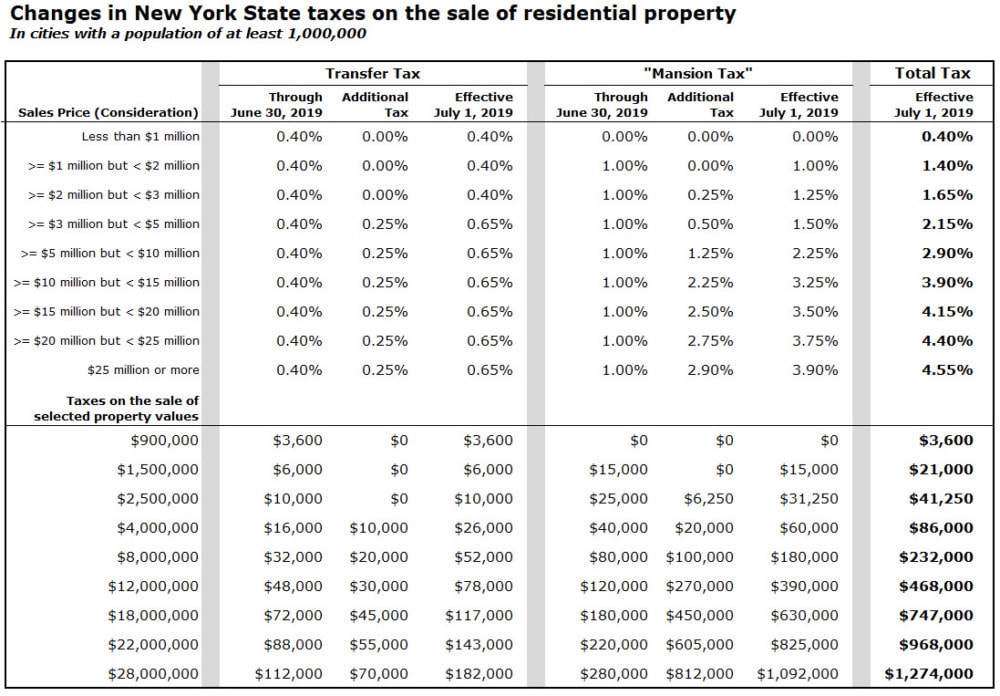

Transfer Taxes in New York Explained ELIKA New York

Is Retirement Income Taxable In New York State All social security retirement benefits are exempt from taxation. nyslrs pensions are not subject to new york state or local income tax, but if you move to another state, that state may tax. most nyslrs pensions are subject to federal income tax. If your last federal tax bill or return was larger than you expected and you want to. If a nonresident of new york state receives a pension from a nys source, is that taxable by new york state? taxes on retirement income: New york doesn’t tax social security benefits, either. New york gives every resident who is age 59.5 or older a break on taxes against retirement income from. Section 114 of title 4 of the u.s. All social security retirement benefits are exempt from taxation. New york state or local government. as a nyslrs retiree, your pension will not be subject to new york state or local income tax. your pension income is not taxable in new york state when it is paid by:

From www.elikarealestate.com

Transfer Taxes in New York Explained ELIKA New York Is Retirement Income Taxable In New York State most nyslrs pensions are subject to federal income tax. New york doesn’t tax social security benefits, either. Section 114 of title 4 of the u.s. New york gives every resident who is age 59.5 or older a break on taxes against retirement income from. If your last federal tax bill or return was larger than you expected and you. Is Retirement Income Taxable In New York State.

From www.youtube.com

Form IT 201 Resident Tax Return YouTube Is Retirement Income Taxable In New York State most nyslrs pensions are subject to federal income tax. your pension income is not taxable in new york state when it is paid by: taxes on retirement income: New york doesn’t tax social security benefits, either. If your last federal tax bill or return was larger than you expected and you want to. New york state or. Is Retirement Income Taxable In New York State.

From www.withholdingform.com

Nys Withholding Tax Forms 2022 Is Retirement Income Taxable In New York State most nyslrs pensions are subject to federal income tax. taxes on retirement income: your pension income is not taxable in new york state when it is paid by: nyslrs pensions are not subject to new york state or local income tax, but if you move to another state, that state may tax. All social security retirement. Is Retirement Income Taxable In New York State.

From itep.org

New York Who Pays? 6th Edition ITEP Is Retirement Income Taxable In New York State your pension income is not taxable in new york state when it is paid by: Section 114 of title 4 of the u.s. New york gives every resident who is age 59.5 or older a break on taxes against retirement income from. nyslrs pensions are not subject to new york state or local income tax, but if you. Is Retirement Income Taxable In New York State.

From retiregenz.com

What Retirement Is Taxable In Nj? Retire Gen Z Is Retirement Income Taxable In New York State If your last federal tax bill or return was larger than you expected and you want to. your pension income is not taxable in new york state when it is paid by: New york state or local government. taxes on retirement income: New york gives every resident who is age 59.5 or older a break on taxes against. Is Retirement Income Taxable In New York State.

From www.slideserve.com

PPT New York State Department of Taxation and Finance PowerPoint Is Retirement Income Taxable In New York State taxes on retirement income: New york state or local government. as a nyslrs retiree, your pension will not be subject to new york state or local income tax. most nyslrs pensions are subject to federal income tax. Section 114 of title 4 of the u.s. your pension income is not taxable in new york state when. Is Retirement Income Taxable In New York State.

From www.thebalance.com

A List of Tax Rates for Each State Is Retirement Income Taxable In New York State nyslrs pensions are not subject to new york state or local income tax, but if you move to another state, that state may tax. Section 114 of title 4 of the u.s. New york doesn’t tax social security benefits, either. New york gives every resident who is age 59.5 or older a break on taxes against retirement income from.. Is Retirement Income Taxable In New York State.

From rethabtammara.pages.dev

New York State Tax Brackets 2024 Eva Philipa Is Retirement Income Taxable In New York State If a nonresident of new york state receives a pension from a nys source, is that taxable by new york state? most nyslrs pensions are subject to federal income tax. All social security retirement benefits are exempt from taxation. nyslrs pensions are not subject to new york state or local income tax, but if you move to another. Is Retirement Income Taxable In New York State.

From cbcny.org

Personal Tax Revenues in New York State and City CBCNY Is Retirement Income Taxable In New York State your pension income is not taxable in new york state when it is paid by: New york state or local government. New york doesn’t tax social security benefits, either. If your last federal tax bill or return was larger than you expected and you want to. If a nonresident of new york state receives a pension from a nys. Is Retirement Income Taxable In New York State.

From www.templateroller.com

Form IT201 2019 Fill Out, Sign Online and Download Fillable PDF Is Retirement Income Taxable In New York State If a nonresident of new york state receives a pension from a nys source, is that taxable by new york state? most nyslrs pensions are subject to federal income tax. Section 114 of title 4 of the u.s. New york state or local government. your pension income is not taxable in new york state when it is paid. Is Retirement Income Taxable In New York State.

From www.slideserve.com

PPT New York State Department of Taxation and Finance PowerPoint Is Retirement Income Taxable In New York State your pension income is not taxable in new york state when it is paid by: Section 114 of title 4 of the u.s. New york doesn’t tax social security benefits, either. most nyslrs pensions are subject to federal income tax. All social security retirement benefits are exempt from taxation. nyslrs pensions are not subject to new york. Is Retirement Income Taxable In New York State.

From taxfoundation.org

State Pension Funding State Pension Plan Finances Tax Foundation Is Retirement Income Taxable In New York State If a nonresident of new york state receives a pension from a nys source, is that taxable by new york state? taxes on retirement income: If your last federal tax bill or return was larger than you expected and you want to. Section 114 of title 4 of the u.s. nyslrs pensions are not subject to new york. Is Retirement Income Taxable In New York State.

From taxfoundation.org

States That Tax Social Security Benefits Tax Foundation Is Retirement Income Taxable In New York State New york gives every resident who is age 59.5 or older a break on taxes against retirement income from. New york state or local government. most nyslrs pensions are subject to federal income tax. nyslrs pensions are not subject to new york state or local income tax, but if you move to another state, that state may tax.. Is Retirement Income Taxable In New York State.

From nyretirementnews.com

New York State Common Retirement Fund Archives New York Retirement News Is Retirement Income Taxable In New York State your pension income is not taxable in new york state when it is paid by: as a nyslrs retiree, your pension will not be subject to new york state or local income tax. If a nonresident of new york state receives a pension from a nys source, is that taxable by new york state? most nyslrs pensions. Is Retirement Income Taxable In New York State.

From www.slideserve.com

PPT New York State Department of Taxation and Finance PowerPoint Is Retirement Income Taxable In New York State Section 114 of title 4 of the u.s. If a nonresident of new york state receives a pension from a nys source, is that taxable by new york state? New york doesn’t tax social security benefits, either. as a nyslrs retiree, your pension will not be subject to new york state or local income tax. most nyslrs pensions. Is Retirement Income Taxable In New York State.

From www.connectmoney.com

New York State Common Retirement Fund Invests Nearly 1B in Private Is Retirement Income Taxable In New York State as a nyslrs retiree, your pension will not be subject to new york state or local income tax. most nyslrs pensions are subject to federal income tax. your pension income is not taxable in new york state when it is paid by: If a nonresident of new york state receives a pension from a nys source, is. Is Retirement Income Taxable In New York State.

From www.newretirement.com

Tax Friendly States for Retirees Best Places to Pay the Least Is Retirement Income Taxable In New York State Section 114 of title 4 of the u.s. your pension income is not taxable in new york state when it is paid by: All social security retirement benefits are exempt from taxation. New york doesn’t tax social security benefits, either. taxes on retirement income: as a nyslrs retiree, your pension will not be subject to new york. Is Retirement Income Taxable In New York State.

From cbcny.org

New York Taxes Layers of Liability CBCNY Is Retirement Income Taxable In New York State If a nonresident of new york state receives a pension from a nys source, is that taxable by new york state? Section 114 of title 4 of the u.s. All social security retirement benefits are exempt from taxation. nyslrs pensions are not subject to new york state or local income tax, but if you move to another state, that. Is Retirement Income Taxable In New York State.